Join our Telegram Channel HERE 🔥

by Bogdan Ulmu

Updated 08 Sep 2025

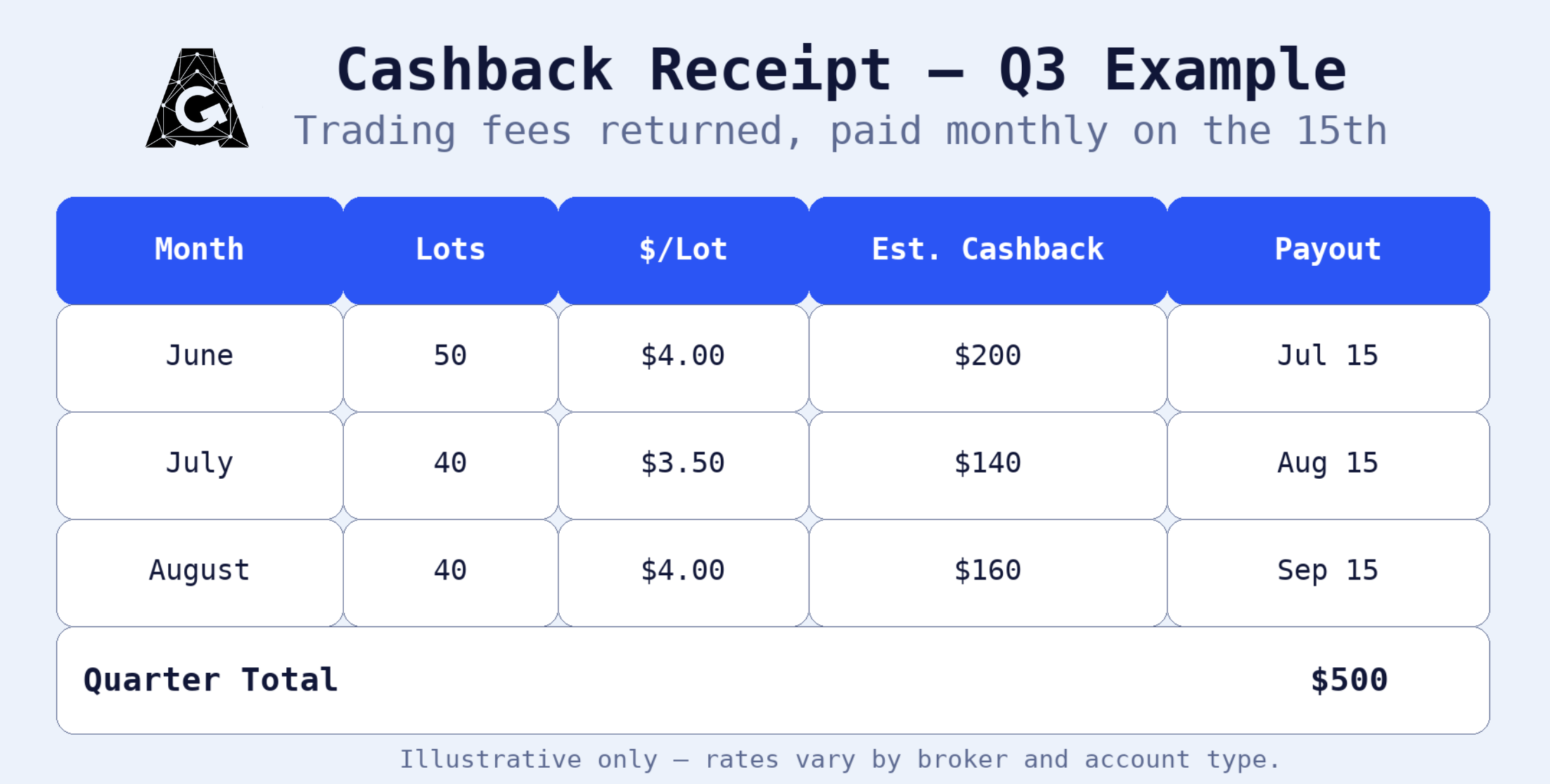

Every trade carries a cost. On ECN/RAW accounts, you see it as a commission; on Standard or “all-in spread” accounts, it’s baked into the spread. Cashback returns a portion of those costs to you, predictably and on a schedule you can rely on. Think of it as “fee-back” - you trade as usual, but a slice of the fees is returned to your balance on the 15th of each month. This reliability is functional: it improves your breakeven by a small, measurable amount and adds a cash-flow moment you can plan around. At Artisgain, payouts are made monthly on the 15th via cryptocurrency or bank transfer.

Imagine three ordinary months. In June, you trade 50 lots, with an effective rate of $4 per lot. That month yields $200, paid on July 15. In July, your volume is 40 lots and the rate is $3.50 per lot; that’s $140, paid August 15. August returns to 40 lots at $4 per lot; that’s $160, spent September 15. Add those three deposits—$200, $140, and $ 160—and you arrive at roughly $500 for the quarter.

If you prefer to double-check the math, divide the total returned fees by the total lots: $500 ÷ 130 = $3.85 per lot on average. For a major pair like EURUSD, a common rule of thumb is that one pip is approximately $10 per standard lot. That means the $3.85 per-lot average is roughly 0.38 pips. Taken trade by trade, 0.38 pips looks tiny; stretched across dozens or hundreds of trades, it’s the kind of incremental edge that helps your bottom line without changing how you trade.

Start by collecting last month’s activity in the format you naturally use. If you think in lots, list your lots by instrument. If you manage by notional, note your total notional. If you’re on an ECN/RAW account, write down the commission per lot you paid, because many programs express returns as a percentage of that commission.

Next, normalise everything to a single unit so comparisons are fair. The easiest target unit is dollars per lot. If your offer is already quoted as $/lot, you’re done. If it’s quoted per $1 million of notional, divide by 10 to reach $/lot (since 10 standard lots equal $1 million notional). If it’s a percentage of commission, multiply your commission per lot by the rate. If the offer is expressed in pips on a major pair, multiply pips by roughly $10 per lot to get a $/lot figure. Once each instrument has a $/lot value, multiply by the lots you actually traded in that instrument and add the results. That sum is your month’s estimated cashback. Divide the sum by your total lots to see your own blended $/lot, which helps you compare months and programs at a glance.

The simplest structure pays a fixed dollar amount per lot, for example $4/lot. Another standard structure pays per $1 million notional, for example $12 per $1M; dividing by 10 turns that into $1.20/lot. On ECN/RAW accounts, a percentage of the commission is typically applied. If your commission is $7/lot and you receive 30% back, that returns $2.10/lot. Understanding these models is crucial as it helps you compare and choose the best cashback program for your trading style. Finally, some programs quote a spread-related figure (for example, a portion of a pip). For majors, converting pips to dollars per lot is straightforward: 0.2 pip is approximately $ 2 per lot, 0.4 pip is roughly $ 4 per lot, and so on.

Two things move your quarterly total more than anything else: the number of lots and the effective $/lot rate. If you increase volume by about 20% while keeping the same rates, the $500 quarter in our example climbs toward $600. If your effective rate rises or falls by 50 cents per lot, the impact on 130 lots is about $65 either way. Instrument mix matters too. Majors often return more predictably; metals and indices can differ. If, for one month, you trade 30 lots of EURUSD at $4/lot and 10 lots of XAUUSD at $2.50/lot, your month would be $145, and your blended rate would be $145 ÷ 40 = $3.63/lot. Understanding these factors and optimising them can significantly increase your cashback without altering your trading strategy.

The most common mistake is comparing offers in different units without converting. As soon as you normalise to $/lot (or, if you prefer, $ per $1 million), programs line up cleanly, and you can see which one suits your trading style. A second mistake is applying EURUSD math to metals or indices. Pip and tick values vary; convert each instrument to dollars per lot before blending. A third is forgetting that account eligibility and promotions can affect whether an account qualifies for returns. Confirm your eligibility with your broker before making a switch. Finally, remember base currency: if payouts are in USD and your account base isn’t, plan for conversion.

Cashback doesn’t generate trading profits; it refunds a portion of your costs. In the quarter-long example, the average improvement is about 0.38 pips per lot on majors. That slight, consistent reduction in cost helps your breakeven and provides a rhythm to your cash-flow payouts on the 15th, which are easy to budget around for data, VPS, research tools, or simply cushioning a rough patch. It’s wise not to chase volume for the sake of rebates; think of cashback as a tailwind that rewards the volume you already trade within your strategy and risk rules.

Artisgain partners with leading brokers, so a portion of your trading fees makes its way back to you without altering your strategy. In practice, you create an account, link eligible broker accounts, trade as usual, and track eligible volume and estimated returns in your dashboard. Payments are made monthly on the 15th via crypto or bank transfer, subject to standard operational timelines. If you’re deciding between ECN and Standard, or you want to confirm whether an existing account can be linked, our team can help you choose the most suitable path.

It isn’t. Cashback is a share of the spreads and commissions you already paid; it doesn’t change execution, and it isn’t compensation for losses.

Yes. Because it’s tied to fees, not P&L, you still receive payouts on the 15th for eligible volume.

Convert every offer to $/lot (or to $ per $1M if you prefer notional), then compute your own blended $/lot using your actual instrument mix.

Divide by 10. For example, $12 per $1M is $1.20/lot.

Multiply by about $10 per lot on EURUSD as a simple rule of thumb.

At Artisgain, payouts land on the 15th of each month.

Author: Bogdan Ulmu, Marketing Specialist at Artisgain. Bogdan focuses on forex cashback education, SEO/SGE content, and simple user journeys from calculator to linking and payout.

Methodology: The figures in this article are illustrative. We normalise different program formats to dollars per lot, allowing for consistent comparison. We also apply the standard rule of thumb that one pip on EURUSD is roughly equivalent to $10 per standard lot. Your results will depend on your account type, instruments, and monthly mix; the calculator will give you a precise estimate.

Editorial review: Artisgain’s Product and Support teams reviewed this guide for clarity and alignment with current platform flows.

If you want the exact number for last month, use the forex cashback calculator and run your figures across the three models you encounter most often: per lot, per $ 1 million, and percentage of commission. This is an incredible yet simple tool which will help you have a clearer view of your potential forex rebates on Artisgain.

Bogdan Ulmu is a financial writer and trading marketing professional who crafts clear, user-friendly guides, tutorials, and tips for investors at every level. Known for breaking down market trends, he blends analytical insight with practical strategies to help readers confidently navigate the fast-paced world of finance.

Comments

Let us know what you think about this article or ask any questions you may have.

You need to be logged in to comment

Any questions? Reach out to us, and we'll get back to you shortly.

info@artisgain.com