Join our Telegram Channel HERE 🔥

by

Updated 08 Sep 2025

Losses are a fact of trading. Even the best systems include losing trades - they are part of the probability curve. What many traders forget, though, is that every trade also comes with an invisible tax: the fees you pay your broker.

Whether you win or lose, you’ve already paid the spread or commission to open the position. The spread is the difference between the buy and sell price, and the commission is the fee charged by the broker for facilitating the trade. Over time, these costs add up. They are the reason your break-even point isn’t zero - it’s a few pips away.

This is where forex cashback makes a real difference. It doesn’t erase your losses, but it does reduce the drag caused by trading costs. Think of it as fee-back: a way to recover part of what you’ve already paid.

Before we begin, let’s clear up a few common misconceptions.

Cashback is not a bonus. It’s not conditional money, a trading credit, or something that affects your leverage or margin. It is simply a share of the fees you’ve already paid, returned to you.

Cashback isn’t tied to your profit and loss (P&L) statement. Whether your trade wins or loses, cashback is calculated based on volume and the broker’s fee structure. That means even in losing months, you get paid.

Cashback doesn’t change execution. Your trades still go directly to your broker with the same spreads and commissions. The difference is that Artisgain shares part of the broker’s revenue with you.

Cashback is not compensation for losses. If you lose $1000, cashback won’t cover that. However, it might return $30, $50, or even $100, depending on your traded volume, reducing the total hit.

Let’s walk through an everyday scenario.

For instance, if you open a 1 lot EURUSD trade and it closes with a loss of $50, your broker charges you $7 in commission on that lot. With Artisgain’s cashback, you get 30% of that commission back - that’s $2.10. This means your loss isn't $ 50 anymore. It's $ 47.90. This reduction may seem small, but when applied to multiple trades, it can significantly cushion your losses.

Your loss isn’t $50 anymore. It’s $47.90.

Now, imagine this across 100 trades in a month. If 60 of them lose, cashback doesn’t erase the red trades - but it cushions them. Your net result is always slightly better than it would have been without cashback.

Cashback may feel small in one trade, but across weeks and months, it stacks up.

Month 1: You trade 80 lots. Average cashback = $3.50/lot → $280 back.

Month 2: You trade 100 lots. Average cashback = $4.00/lot → $400 back.

Month 3: You trade 90 lots. Average cashback = $3.80/lot → $342 back.

By the end of the quarter, that’s over $1,000 paid back - even if your P&L included losses.

For active traders, cashback can represent hundreds or even thousands of dollars every quarter, creating a significant cash flow buffer.

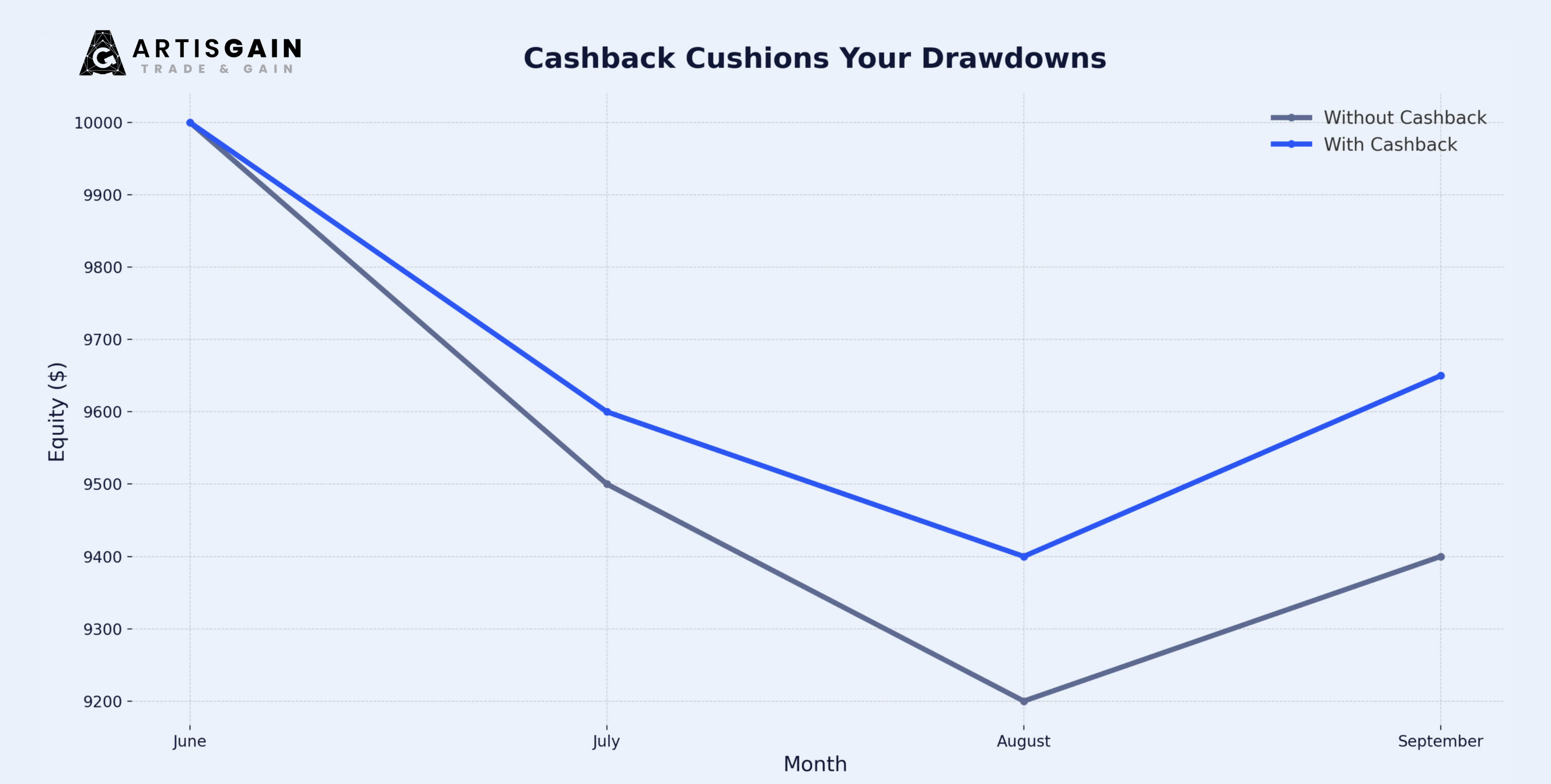

When your strategy hits a drawdown, it’s easy to feel discouraged. Cashback helps in three key ways.

First, there’s a significant psychological relief. Losing trades feel less punishing when you know part of the costs are returned. This slight offset reduces frustration and keeps you disciplined, providing a sense of reassurance during challenging periods.

Second, your break-even point significantly improves. If your costs per trade drop from 2 pips to 1.6 pips because of cashback, your system doesn’t need to win as often to stay profitable. This can boost your confidence in your trading strategy.

And third, the consistency of payouts helps with cash flow. Since cashback is paid monthly on the 15th, you have a predictable inflow, regardless of performance. This can cover data feeds, VPS services, or provide peace of mind.

Not all cashback is structured the same.

Per-lot cashback: $4/lot. If you trade 50 lots in a losing month, you still receive $200 on the 15th.

Per-$1M notional: $12 per $1M. Equivalent to $1.20/lot. Works the same way - volume matters, not win rate.

Commission share (ECN/RAW accounts): 30% of $7/lot commission = $2.10/lot. Even if the trade loses, the commission refund still applies.

Spread-based rebates: 0.3 pip rebate on EURUSD. With 100 losing trades at one lot each, that’s ~$300 returned.

The key takeaway is that every model pays on volume, not on outcome. Losses don’t cancel cashback.

Even though cashback is simple, traders make mistakes when evaluating it.

One common mistake is confusing cashback with bonuses. Cashback is cash. Bonuses are often trading credits with restrictions.

Another mistake is overtrading to earn more rebates. Cashback should reward your existing strategy, not encourage poor habits.

Eligibility also matters. Not every broker account type is eligible. Always confirm whether your account qualifies.

Imagine two traders, both running the same strategy.

Trader A (no cashback): 200 trades in a quarter, $1,000 in net losses after fees.

Trader B (with cashback): Same 200 trades, same losses, but earns $600 in cashback. Net loss = $400.

Both traded identically. But Trader B has reduced his drawdown by 60%. That’s the protective effect of cashback.

Artisgain was designed to make cashback simple, transparent, and reliable.

There are no hidden conditions - cashback is always calculated on fees, not P&L.

Payouts are monthly, on the 15th, via crypto or bank transfer.

We only partner with brokers who support transparent tracking.

Your dashboard lets you track volume, estimates, and payouts all in one place.

Check your cashback with our free profit calculator and see what last month’s trades could have returned.

No. It’s not a trading bonus or credit. Cashback is real money, paid monthly, based on fees you already paid.

Yes. Cashback is independent of profit or loss. It’s tied only to trading volume and broker fees.

Not directly. But it reduces your net costs, improving your break-even and reducing drawdowns.

Convert everything to $/lot (or $ per $1M) and compute your blended average based on your own instrument mix.

Always on the 15th of the month, via crypto or bank transfer.

Written by Jordan Malone, CFTe, a full-time currency trader with more than twelve years of live market data under his belt. He runs execution cost research for a European proprietary desk and speaks at the London Trader Expo on low-latency routing. Jordan’s articles on forex rebates, spread optimisation, and micro-structure appear in Finance Magnates and on the CFA Society blog. Every guide he publishes on Artisgain pulls from that same verified trade log.

All examples are illustrative. We normalise rebate formats to $/lot for clarity, and use the rule of thumb that 1 pip on EURUSD ≈ $10 per lot. Traders should compute their actual blended rate using the Artisgain profit calculator.

Reviewed by the Artisgain Product & Support teams to ensure accuracy and alignment with broker integrations.

Losing trades are unavoidable. But losing all your fees doesn’t have to be. Cashback gives you back a share of your costs - predictably, reliably, and without affecting your strategy.

Every trade may not be a winner, but every trade can still pay you back.

Ready to see your numbers? Use the Artisgain profit calculator and find out what cashback could have been protected for you last month.

Comments

Let us know what you think about this article or ask any questions you may have.

You need to be logged in to comment

Any questions? Reach out to us, and we'll get back to you shortly.

info@artisgain.com