ICMarkets Review

IC Markets is a low-risk, highly dependable broker tailored for experienced traders. Boasting a trust score of 4.8/5 on Trustpilot, it delivers world-class educational materials, an extensive online library, and a streamlined copy-trading platform that lets you easily mirror elite strategies.

🔒 Regulated and trusted by the ASIC (Australia), CySEC (Cyprus), and FSA (Seychelles).

📈 Chosen by 28500+ new traders in the last 90 days.

🌍 Available for most worldwide traders

Note: The number of new traders is based on the latest available data.

ICMarkets Review 2025 – Comprehensive Broker Analysis

💡 ICMarkets at a Glance

📜 ICMarkets Broker Overview

✨ Key Features of ICMarkets

⭐️ ICMarkets Customer Reviews and Ratings

⚡ ICMarkets Advantages Compared to Competitors

🔒 Is ICMarkets Safe and Secure?

🎁 ICMarkets Sign-Up Bonus and Promotions

🤝 ICMarkets Affiliate Program Explained

💵 ICMarkets Minimum Deposit Requirements

📂 Types of ICMarkets Accounts

📝 How to Open an ICMarkets Account – Step-by-Step Guide

💻 ICMarkets Trading Platforms and Tools Overview

📲 ICMarkets Mobile Trading Experience

🤖 ICMarkets AI Integration & Smart Trading Tools

🌍 ICMarkets Range of Markets & Trading Assets

⚖️ Compare ICMarkets vs. Other Forex Brokers

💸 ICMarkets Fees, Spreads, and Commissions Explained

💳 ICMarkets Deposit and Withdrawal Methods

📚 ICMarkets Education and Market Research

📘 ICMarkets Forex Trading Guides for Beginners

🌎 Top Countries Using ICMarkets

⭐ In-Depth Customer Review & Feedback

📞 ICMarkets Customer Support Quality

✅ ICMarkets Pros and Cons – Quick Summary

🔚 Conclusion – Is ICMarkets Worth It?

❓ Frequently Asked Questions (FAQs)

🔗 References & Resources

💹 What you should know about ICMarkets

|

Category

|

Details

|

|

Company Information

|

|

|

🏷️Company Name

|

ICMarkets

|

|

📍Headquarters Location

|

Sydney, Australia

|

|

📅Year Established

|

2007

|

|

👤Group Companies

|

True ECN Trading Pty Ltd, IC Markets Ltd

|

|

🌐Global Offices

|

Australia

Seychelles

Cyprus

|

|

🔖Licensing Body

|

ASIC (Australia)

CySEC (Cyprus)

FSA (Seychelles)

|

|

👥Group Companies

|

ICMarkets Financial Services Ltd,

ICMarkets UK Ltd,

ICMarkets Global Markets Ltd

|

|

🏛️Business Model

|

ECN (Electronic Communication Network)

|

|

🌍Operational Languages

|

Multiple languages, including English, Spanish,

German,

Arabic, Chinese,

and more

|

|

🏆Awards & Recognitions

|

Best Forex ECN Broker 2023, Global Forex Awards and many more

|

|

Regulation and Security

|

|

|

🛡️Regulation

|

ASIC (Australia), CySEC (Cyprus), FSA (Seychelles)

|

|

✔️Compliance Standards

|

MiFID II,

GDPR

|

|

💼Client Fund Segregation

|

Yes - in Tier-1 banks

|

|

🪫Negative balance protection

|

Yes

|

|

🕵️♂️Financial Conduct Oversight

|

Yes - Periodic audits and various compliance checks

|

|

💰Insurance Coverage

|

Yes, but the amount is not explicitly mentioned.

|

|

📋AML & KYC Policy

|

Fully enforced

|

|

🔒Security of Trading Platform

|

SSL encryption,

multi-layer authentication

|

|

🛡️Investor Compensation Fund

|

Yes (under CySEC)

|

|

🖥️Cybersecurity Measures

|

Advanced firewalls, DDoS protection and various intrusion detection systems

|

|

Account Types and Features

|

|

|

⚙️Standard Account

|

Yes

|

|

📊ECN Account

|

Yes

|

|

🌙Islamic Account

|

Yes (Swap-free)

|

|

🎮Demo Account

|

Yes

|

|

👑VIP Account

|

Not available

|

|

💵Minimum Deposit

|

200 USD

|

|

💱Base Currencies

|

USD,

EUR,

GBP,

CHF,

SGD

|

|

⚖️Leverage Options

|

Up to 1:500

|

|

📈Spreads (Fixed/Variable)

|

Variable (starting from 0.0 pips)

|

|

🔄Swap-Free Accounts

|

Available

|

|

🌐Account Currency Conversion

|

Yes

|

|

🚨Margin Call Level

|

100%

|

|

❌Stop-Out Level

|

50%

|

|

🔄Hedging Allowed

|

Yes

|

|

⚡Scalping Allowed

|

Yes

|

|

🔁Copy Trading Support

|

Yes (via third-party platforms)

|

|

👥Social Trading Features

|

Yes

|

|

💼Managed Accounts

|

Yes, via MAM/PAMM

|

|

Trading Conditions

|

|

|

🔍Average Spreads

|

From 0.0 pips (for the ECN account)

|

|

💲Commissions per Trade

|

$3.50 per side (ECN accounts)

|

|

🔢Leverage Range

|

Up to 1:500

|

|

🚀Execution Speed

|

<40ms (average)

|

|

📊Order Execution Type

|

Market Execution

|

|

🔄Slippage Policy

|

Low slippage

|

|

📏Margin requirements

|

1-2%

|

|

⏹️Stop-Loss and Take-Profit Orders

|

Yes

|

|

🔁Trailing Stops

|

Yes

|

|

🕑Pending Orders

|

Yes

|

|

🔽Partial Fills

|

Supported

|

|

🧾Dividend Adjustments

|

Yes

|

|

🌙Overnight Swap Fees

|

Applicable

|

|

📆Rollover Policy

|

Follows market standards

|

|

🛑Guaranteed Stop Loss

|

No

|

|

Trading Instruments

|

|

|

💹Forex Currency Pairs

|

60+

|

|

🪙Precious Metals (Gold/Silver)

|

Yes

|

|

📈Indices

|

Yes

|

|

🌾Commodities

|

Yes

|

|

⛽Energies

(Oil/Natural Gas)

|

Yes

|

|

₿Cryptocurrencies

|

Yes

|

|

📉Stocks

|

100+

|

|

🗂️ETFs

|

Yes

|

|

🏛️Bonds

|

No

|

|

📜Futures Contracts

|

No

|

|

🛡️Options Contracts

|

No

|

|

⚖️CFDs

(Contracts for Difference)

|

Yes

|

|

🔣Swap on Trading Board

|

Available

|

|

🔀Leveraged Instruments

|

Yes

|

|

🎯Micro-Lot Trading

|

Yes

|

|

💸Spread Betting

|

Not supported

|

|

🧺Currency Baskets

|

No

|

|

Deposits and Withdrawals

|

|

|

💳Deposit Methods

|

Credit/Debit Cards,

Bank Wire Transfers,

E-Wallets,

Crypto,

Local Payment Methods

|

|

💵Withdrawal Methods

|

Credit/Debit Cards,

Bank Wire Transfers,

E-Wallets,

Crypto

|

|

⏱️Processing Time for Deposits

|

Instant for most methods,

1-2 business days for bank transfers

|

|

🕒Processing Time for Withdrawals

|

1 business day for approval; additional time varies by payment method

|

|

🚫Deposit Fees

|

No

|

|

💵Withdrawal Fees

|

None for most methods,

Bank transfer fees may apply

|

|

🔢Minimum Deposit Amount

|

$200

|

|

📉Minimum Withdrawal Amount

|

$1 for e-wallets, varies for other methods

|

|

🚪Maximum Withdrawal Limit

|

No specific limit

|

|

💱Supported Currencies

|

USD,

EUR,

GBP,

AUD,

CHF,

and more

|

|

₿Crypto Deposits & Withdrawals

|

Supported

|

|

🏦Bank Wire Transfers

|

Yes

|

|

💳Credit/Debit Cards

|

Yes

|

|

📲E-Wallets

(Skrill, Neteller, etc.)

|

Yes

|

|

🏘️Local Payment Methods

|

Supported

|

|

Trading Platforms and Tools

|

|

|

💻MetaTrader 4 (MT4)

|

Yes

|

|

👩💻MetaTrader 5 (MT5)

|

Yes

|

|

🖥️Proprietary Platform

|

Not available

|

|

📱Mobile Trading App

|

Yes

|

|

🌐Web-Based Platform

|

Yes

|

|

🤖Trading Bots

|

Supported

|

|

🖧VPS Services

|

Available

|

|

🔌API Connectivity

|

Available

|

|

📉Charting Tools

|

Comprehensive,

with multiple indicators,

drawing tools,

and timeframes.

|

|

🧮Custom Indicators

|

Supported

|

|

🧠Market Sentiment Analysis

|

Not available

|

|

📩Trading Signals

|

Available

|

|

🏷️Advanced Order Types

|

Available

|

|

⚠️Risk Management Tools

|

Available

|

|

📅Economic Calendar

|

Yes

|

|

📰Market News Feed

|

Yes

|

|

Customer Support

|

|

|

📞Support Channels

|

Live chat,

E-mail,

Phone support.

|

|

🗨️Live Chat Availability

|

Yes, 24/5 quick assistance.

|

|

📧Email Support

|

Available

|

|

📱Phone Support

|

Available

|

|

🌍Multilingual Support

|

Yes

|

|

❓Help Center/FAQ

|

Comprehensive FAQ section on the ICMarkets website.

|

|

👨💼Dedicated Account Manager

|

Available

|

|

⏲️Response Time (Live Chat)

|

Usually within a few minutes.

|

|

🕒Response Time (Email)

|

Typically, within 24 hours.

|

|

⭐Support Rating

|

Very positive

|

|

Educational Resources and Support

|

|

|

🎥Webinars

|

Regularly conducted for trading insights and strategies.

|

|

🏫Seminars

|

Occasionally hosted in select locations.

|

|

📖Trading Tutorials

|

Available online, covering platform usage and trading basics.

|

|

📊Market Analysis Reports

|

Available

|

|

📚E-Books

|

Available

|

|

🎬Video Library

|

Available

|

|

📜Glossary

|

Trading glossary available.

|

|

❔FAQs

|

Detailed FAQ section covering common queries available

|

|

🆕Beginner Guides

|

Yes, with resources tailored for new traders.

|

|

🚀Advanced Trading Strategies

|

Guides and webinars for experienced traders.

|

|

Partnerships and Programs

|

|

|

💵ICMarkets Rebates

|

Up to $1.2 per lot

|

|

📋IB Program

|

Available for introducing brokers with competitive commissions.

|

|

🪪Affiliate program?

|

Yes, offering tiered payouts and robust tracking tools.

|

|

🏷️White Label Solutions

|

Offering institutional clients the opportunity to brand their platforms.

|

|

🎁Partnership Rewards

|

Includes rebates and other incentives for partners.

|

|

🏛️Institutional Solutions

|

Tailored services for hedge funds, brokers, and asset managers.

|

|

🔌API Partnership

|

Provides API solutions for algorithmic trading and integration.

|

|

🤝Referral Program

|

Clients can refer friends and earn bonuses.

|

|

Fees & Charges

|

|

|

💳Deposit Fees

|

No

|

|

📤Withdrawal Fees

|

Free for specific methods; some may incur a fee depending on the provider.

|

|

💤Inactivity Fee

|

No

|

|

🌜Overnight Fees (Swaps)

|

Yes

|

|

💱Conversion Fees

|

Applied when trading in a currency different from the account currency.

|

|

💰Commission on Trades

|

$3.50 per lot per side for Raw Spread accounts

|

|

Market Research Tools

|

|

|

📅Economic Calendar

|

Included

|

|

📰Market News

|

Included

|

|

📩Trading Signals

|

Available

|

|

🔧Technical Analysis Tools

|

Robust tools with advanced charting features.

|

|

💭Sentiment Analysis

|

Limited

|

|

Additional Features

|

|

|

👥PAMM/MAM Accounts

|

Supported

|

|

🔗Social Trading Platform

|

Not directly available; third-party integrations are possible.

|

|

🏆Trading Competitions

|

Various competitions are occasionally available

|

|

🎁Loyalty Rewards

|

Available

|

|

👑Exclusive VIP Perks

|

Available for high-tier clients

|

|

Promotions & Bonuses

|

|

|

🎁Welcome Bonus

|

Occasionally offered

|

|

💵Deposit Bonus

|

Rarely available

|

|

🏅Trading Contests

|

Available

|

|

🌟Seasonal Promotions

|

Occasionally offered

|

|

🎖️Loyalty Programs

|

Available

|

|

User Experience & Reviews

|

|

|

🖥️User Interface Quality

|

Intuitive and user-friendly design.

|

|

🔒Platform Stability

|

High stability ensures smooth operations.

|

|

📱Mobile App Reviews

|

Generally positive with a focus on ease of use.

|

|

⭐Overall User Rating

|

4.2/5 on average across platforms.

|

|

🌟Trustpilot Rating

|

Rated highly (4.8/5) for reliability and features.

|

|

😟Common Complaints

|

Withdrawal delays and occasional slippage reports.

|

|

Mobile

|

|

|

📱Mobile App Name

|

ICMarkets Mobile App.

|

|

🛠️Developer

|

ICMarkets

|

|

📅Release Year

|

2018

|

|

💻OS Compatibility

|

iOS, Android.

|

|

🌐Languages Supported

|

Multiple languages.

|

|

📈Trading Instruments

|

Full range including forex, stocks, commodities, and indices.

|

|

🔄Real-Time Data

|

Live market data with real-time updates.

|

|

🛠️Charting Tools

|

Advanced charting tools are available.

|

|

📊Order Types Supported

|

Market, Limit, Stop, OCO and Trailing Stop.

|

|

🚀Order Execution Speed

|

Fast execution

|

|

🔔Custom Alerts

|

Configurable price and event notifications.

|

|

🤝Beginner-Friendly

|

Easy onboarding with tutorials and guides.

|

|

🔐Security Features

|

High-level encryption for user safety.

|

|

🖥️Synchronization

|

Syncs across desktop, mobile,

and web platforms.

|

|

💰Deposit and Withdrawal

|

Simplified through integrated options.

|

|

📝Account Types Accessible

|

All account types are available via the app.

|

|

🔄Switch Accounts

|

Seamless switching between accounts.

|

|

💬In-App Support

|

24/5 live chat and FAQs available.

|

|

📚Educational Resources

|

Integrated learning materials for traders.

|

|

🎯Watchlist

|

Personalised watchlist for tracking favourites.

|

|

🌙Dark Mode

|

Available for user convenience.

|

|

🌐Social Trading

|

Supported through external services.

|

|

AI Trading Resources

|

|

|

🤖AI Integration

|

Available

|

|

📊Data Analysis

|

Available

|

|

📈Predictive Analytics

|

Not available

|

|

🛠️Customizable Strategies

|

Not available

|

|

📉Risk Management Tools

|

Available

|

|

🧑🏫Trading Insights

|

Available

|

|

🚀Execution Optimization

|

Available

|

|

🔄Portfolio Rebalancing

|

Not available

|

|

📚AI Tutorials

|

Not available

|

|

🎥Video Demonstrations

|

Available

|

|

🧑🤝🧑Webinars

|

Available

|

|

🔍AI-Powered Search

|

Not available

|

|

🌟Beginner-Friendly

|

Yes

|

|

🖥️Platform Availability

|

Available

|

|

📈Backtesting Capability

|

Available

|

|

🛠️Strategy Builder

|

Not available

|

|

🔔Alerts and Notifications

|

Available

|

|

🔒Data Protection

|

Compliant with global data security standards.

|

|

👁️🗨️Transparency

|

Clear policies and fee structures.

|

|

Social Media Platforms

|

|

|

📘Facebook

|

Available

|

|

📷Instagram

|

Available

|

|

🐦Twitter

|

Available

|

|

💼LinkedIn

|

Available

|

|

🎥YouTube

|

Available

|

|

👉 Where to start

|

👉 Open Account

|

📑 Overview

Since launching in 2007, IC Markets has built a reputation as a leading global Forex and CFD broker, serving a diverse client base - including active traders in Europe, Asia and South Africa. The firm has prioritised cutting-edge technology and continuous innovation, delivering seamless access to MetaTrader 4, MetaTrader 5, and the cTrader platforms. Each interface is designed for clarity and power, accommodating beginners and seasoned professionals alike, and is fully compatible across desktop, web, and mobile devices.

Beyond its core platforms, IC Markets integrates advanced tools - automated trading systems, deep charting capabilities, and third-party applications - to elevate every aspect of the trading workflow. Backed by one of the industry’s largest liquidity pools, the broker ensures ultra-fast execution with zero requotes. This makes it an ideal choice for high-frequency and scalping strategies popular among traders. Add to this a transparent pricing model featuring raw spreads from 0.0 pips and no hidden fees, and you have a cost-efficient environment engineered for traders who demand both performance and value.

📊 Features Offered

Based in Cyprus and regulated by top-tier authorities, IC Markets has earned its reputation as a go-to broker for traders seeking access to forex, indices, commodities and cryptocurrencies. Its robust multi-platform offering—including MetaTrader 4, MetaTrader 5 and cTrader—delivers lightning-fast execution, a fully customisable interface and advanced charting tools to suit discretionary and algorithmic strategies.

Clients benefit from raw-spread and standard account types, with spreads from 0.0 pips on major pairs and deep institutional liquidity to ensure orders fill instantly without requotes. Whether you’re just starting or running high-frequency/scalping systems, IC Markets supports you with around-the-clock customer service, a comprehensive suite of educational resources, and strict compliance with global regulatory standards.

|

💱Currency Pairs

|

Trade more than 60 FX pairs - including majors, minors and exotics - backed by ultra-tight spreads and deep liquidity.

|

|

📊Stock index CFDs

|

Access key global benchmarks such as the S&P 500, NASDAQ 100, FTSE 100 and DAX with sub-millisecond order execution.

|

|

🏦Stock CFDs

|

Without owning the underlying shares, you can go long or short on blue-chip stocks in the US, UK, and EU markets.

|

|

📈ETF CFDs

|

Diversify across sectors and geographies via a broad selection of Exchange-Traded Funds, all within a single trading account.

|

|

⛏️Commodity CFDs

|

Speculate on energy markets (oil, gas), precious metals (gold, silver) and soft commodities (coffee, sugar) under one roof.

|

|

🏛️Bond CFDs

|

Hedge or gain yield exposure with government-bond CFDs from major US and European economies.

|

|

₿ Crypto

|

Trade-leading digital assets—Bitcoin, Ethereum, Ripple and Litecoin—with competitive spreads and 24/7 market access.

|

📬 ICMarkets Customer Reviews

Feedback on IC Markets is overwhelmingly positive, with traders consistently praising the broker’s ultra-competitive spreads, rapid order execution, and stable trading infrastructure. Many highlight the clarity of the fee schedule and the breadth of account types, noting that transparent pricing makes it easy to compare costs and choose the right plan.

Clients also appreciate the flexibility afforded by multiple platforms—particularly MetaTrader 4, MetaTrader 5, and cTrader—which cater to discretionary and algorithmic strategies. Around-the-clock customer support earns high marks for responsiveness and professionalism, reinforcing IC Markets’ commitment to service excellence.

On the rare occasions when markets spike, a few users report slight delays in withdrawal processing, and a handful have encountered intermittent technical glitches on the platform. Nevertheless, these issues remain exceptions rather than the rule. In recent years, IC Markets’ reputation for reliability and regulation has only strengthened, making it a top choice for novice and veteran traders.

|

Aspect

|

Feedback

|

Rating (Out of 5)

|

|

⭐Overall Rating

|

Achieving an impressive 4.8 / 5 customer rating, IC Markets is lauded for its competitive pricing, rock-solid reliability, and cutting-edge trading infrastructure.

|

⭐⭐⭐⭐⭐

|

|

💬 Positive Feedback

|

Traders consistently praise IC Markets for its razor-tight spreads, lightning-fast execution, and extensive range of tradable instruments.

|

⭐⭐⭐⭐

|

|

😟 Common Complaints

|

Common complaints centre on occasional withdrawal processing delays and marginally higher fees for lower-volume traders.

|

⭐⭐⭐⭐⭐

|

|

📊 User Experience

|

Traders praise IC Markets for its intuitive, smooth interface, powerful trading tools, and prompt, professional customer support.

|

⭐⭐⭐⭐⭐

|

|

🌟 Customer Satisfaction

|

With an average customer rating of 4.8 ⁄ 5, IC Markets is widely praised for its competitive pricing, rock-solid reliability, and cutting-edge trading infrastructure. Traders consistently highlight the broker’s razor-thin spreads, lightning-fast order execution, and a range of instruments as major strengths.

|

⭐⭐⭐

|

Key Benefits of Trading with IC Markets

-

Optimised for Algorithmic & EA Trading

Leverage IC Markets’ infrastructure - built for automated systems - with lightning-fast execution and zero requotes, ensuring your algorithms and Expert Advisors run seamlessly around the clock.

-

Robust Regulatory Protection

Trade with confidence under multiple top-tier regulators. IC Markets’ stringent compliance and segregated client accounts to deliver the security risk-averse traders demand.

-

Comprehensive Education Hub

Stay ahead with live webinars, on-demand tutorials, and in-depth articles. Whether you’re refining advanced strategies or mastering new tools, IC Markets’ learning resources support continuous skill development.

-

Global & Regional Market Access

You can access a broad universe of currency pairs—including African-specific crosses—alongside major FX, commodities, indices, equities, and cryptocurrencies. This diversity is ideal for traders and anyone targeting emerging-market opportunities.

-

Deep Liquidity & Minimal Slippage

Tap into an extensive pool of institutional liquidity that easily handles large order volumes. High-volume traders benefit from efficient fills and negligible price impact.

-

Scalper & Day-Trader Friendly

Take advantage of raw spreads from 0.0 pips, ultra-low latency, and sub-millisecond execution. IC Markets’ environment is tailor-made for quick-in, quick-out strategies where every tick counts.

-

Cutting-Edge Trading Platforms

Choose between MetaTrader 4, MetaTrader 5, and cTrader. Each offers advanced charting, customisable interfaces, and support for automated scripts so tech-savvy traders can effortlessly deploy sophisticated tactics.

-

Diverse Instrument Selection

From FX and CFDs on indices to commodities, stocks, bonds, and digital assets, IC Markets’ product lineup empowers you to diversify your portfolio and explore multiple asset classes under one account.

Customers Ratings

|

🌐 Platform

|

📝 Feedback Summary

|

⭐ Rating

|

|

🔖Google

|

Overall sentiment is positive, with traders praising the platform’s intuitive interface and the efficiency of its customer support.

|

⭐⭐⭐⭐⭐

|

|

🔖HelloPeter

|

Overall, IC Markets garners strong approval from traders, who consistently applaud its razor-thin spreads, dependable trading platforms, and standout customer support.

|

⭐⭐⭐⭐⭐

|

|

🔖TrustPilot

|

Customer sentiment for IC Markets remains overwhelmingly positive, with traders lauding its transparent pricing, lightning-fast execution, and highly responsive support team.

|

⭐⭐⭐⭐⭐

|

🎯 IC Markets - Advantages over Competitors

-

IC Markets delivers a truly client-centric trading experience, with around-the-clock, highly trained support available 24/7. Traders benefit from some of the industry’s tightest spreads - raw spreads from 0.0 pips on major FX pairs - combined with ultra-fast order execution that minimises slippage for scalpers and day traders.

-

Its suite of platforms - MetaTrader 4, MetaTrader 5, and cTrader - blend powerful functionality with an intuitive, customisable interface, catering to every trading style, from discretionary to algorithmic. Complementing these platforms is an extensive education library of live webinars, step-by-step tutorials, and in-depth articles, helping newcomers and veterans sharpen their skills.

-

Multilingual customer care ensures clear, seamless communication in a diverse market, while regulation by top-tier authorities reinforces financial security: client funds are held in segregated accounts at leading banks. Access to deep institutional liquidity lets you execute large orders without market impact, and a range of leverage options enables you to tailor risk to your strategy - though prudent use is advised.

-

Beyond Forex, IC Markets offers CFDs on indices, commodities, stocks, bonds and cryptocurrencies, enabling portfolio diversification and sophisticated hedging. There are no restrictions on trading methods, so you’re free to deploy hedging techniques, EAs or copy-trading bots as you see fit. IC Markets combines competitive pricing, robust infrastructure and comprehensive support to give traders an edge in market conditions.

🏦 Safety and Security

IC Markets puts your safety first. Regulated by ASIC and CySEC, it keeps client funds in segregated bank accounts, so your money is never mixed with company assets. Retail clients also get Negative Balance Protection, meaning you can’t lose more than you deposit. Add strict AML/KYC checks and regular external audits, and you will have a trustworthy trading environment.

IC Markets Global Regulations

|

🔎 Registered Entity

|

🌎Registration Country

|

↪️ Registration Number

|

➡️ Regulatory Entity

|

|

1️⃣ Raw Trading Ltd

|

Seychelles

|

N/A

|

FSA

|

|

2️⃣ International Capital Markets Pty Ltd.

|

Australia

|

CAN 123 289 109

|

ASIC

|

|

3️⃣ IC Markets EU Ltd

|

Cyprus

|

N/A

|

CySEC

|

|

4️⃣ IC Markets Ltd

|

Bahamas

|

76823 C

|

SCB

|

Protection of Client Funds

|

🔎 Security Measure

|

↪️ Information

|

|

🔒 Segregated Accounts

|

Yes

|

|

🔏 Compensation Fund Member

|

No, in-house insurance

|

|

🔐 Compensation Amount

|

$1 million

|

|

🔓 SSL Certificate

|

None

|

|

🗝️ 2FA (Where Applicable)

|

None

|

|

🔑 Privacy Policy in Place

|

Yes

|

|

🔒 Risk Warning Provided

|

Yes

|

|

🔏 Negative Balance Protection

|

Yes

|

|

🔐 Guaranteed Stop-Loss Orders

|

None

|

What regulatory oversight does IC Markets offer for secure trading?

IC Markets operates under stringent international regulations - licensed by ASIC in Australia and CySEC in Cyprus - ensuring full compliance with top-tier financial standards. This robust regulatory framework underpins IC Markets’ security protocols, giving traders confidence in the broker’s legal standing, ethical conduct, and transparent operations.

Does IC Markets protect client funds through segregated accounts?

To guarantee maximum fund security, IC Markets keeps all client deposits in fully segregated accounts at leading global banks, separate from the company’s operational capital. This segregation prevents any co-mingling of assets, so your investment remains protected even in the unlikely event of broker insolvency.

What is IC Markets’ Negative Balance Protection, and how does it safeguard traders?

IC Markets provides Negative Balance Protection for all retail accounts under its ASIC and CySEC entities. This feature ensures you cannot lose more than your available account balance during extreme market volatility - offering extra financial security and peace of mind.

🚀 Sign-Up Bonus

While many brokers entice new clients with sign-up, welcome, or deposit bonuses - including no-deposit offers - IC Markets takes a different path. The broker does not provide promotional bonuses when you open a live trading account, focusing instead on delivering genuine value through ultra-tight spreads, deep institutional liquidity, and lightning-fast execution.

|

🔎 Broker

|

🥇 IC Markets

|

|

🎉 Sign-Up Bonus

|

No

|

|

🎀 Welcome Bonus

|

No

|

|

🎁 No Deposit Bonus

|

No

|

|

🚀 Open an Account

|

👉 Open Account

|

Does ICMarkets offer a welcome bonus?

ICMarkets does not offer a traditional welcome bonus or sign-up incentive for new traders. However, the broker delivers value through competitive trading conditions, tight spreads, and high-quality services rather than promotional offers.

What about Cashback with ICMarkets?

Instead of bonuses, ICMarkets enables traders to safely earn forex cashback, allowing them to recover a portion of their trading fees. Cashback rewards are paid directly to traders without restrictive terms or hidden conditions, making cashback rebates a transparent and beneficial alternative to traditional bonuses.

📊 ICMarkets Minimum Deposit

IC Markets requires a minimum initial deposit of $200 to open a live trading account. This entry point sits comfortably alongside industry peers, ensuring new and budget-conscious traders can access advanced platforms, deep liquidity, and competitive pricing without prohibitive upfront costs.

|

🔎 Account Type

|

🚀 Open an Account

|

💰 Minimum Deposit

|

|

🏅 Standard Account

|

👉 Open Account

|

$200

|

|

🏅 Raw Spread Account

|

👉 Open Account

|

$200

|

What is the minimum deposit required by ICMarkets?

ICMarkets requires a minimum deposit of USD 200 to open a new trading account.

How long does it take for a deposit to reach my ICMarkets account?

For International Bank Transfers: Typically processed within 2-5 business days, depending on your bank. For SEPA and local transfers: Usually credited within the same business day, ensuring quicker access to your funds.

💶 ICMarkets Account Types

IC Markets provides traders with two primary live account types - Standard and Raw Spread (MT4, MT5 and cTrader) - alongside Demo and Islamic (swap-free) accounts. All live accounts require a minimum deposit of USD 200, feature floating spreads from 0.0 pips, and offer maximum leverage up to 1:500. This flexible structure ensures that whether you’re testing strategies in a risk-free demo environment, trading in compliance with Sharia principles, or seeking ultra-tight spreads and high leverage, there’s an IC Markets account to match your needs.

|

🔎 Account

|

🏅 Standard

|

🥇 Raw Spread

|

|

💰 Minimum Deposit

|

200 USD

|

200 USD

|

|

🔁 Spreads from

|

0.6 Pips

|

0 Pips

|

|

📉 Leverage

|

1:500

|

1:500

|

|

💻 Instruments

|

64 Currency Pairs, Index CFD

|

64 Currency Pairs, Index CFD

|

|

🚀 Open an Account

|

👉 Open Account

|

👉 Open Account

|

Islamic Account

The broker offers Islamic swap-free trading at a standard trading account level.

ICMarkets offers Extended Swap-free status by default to all applicable trading accounts created by clients in non-Islamic countries.

|

🔎 Broker

|

🥇 IC Markets

|

|

☪️ Islamic Account

|

Yes

|

|

🔁 Swap-Free

|

Yes

|

|

📍 Registration

|

Via Customer Support

|

|

🚀 Open an Account

|

👉 Open Account

|

Demo Account

The broker does offer a free demo trading account for beginners to practice forex trading in a 100% risk-free environment. The ICMarkets demo account expires after 180 days.

|

🔎 Broker

|

🥇 IC Markets

|

|

🪙 Pricing

|

Real-Time

|

|

💳 Virtual Funds

|

100K

|

|

💵 Base Currencies

|

8

|

|

⚙️ Life Span

|

180 Days

|

|

🚀 Open an Account

|

👉 Open Account

|

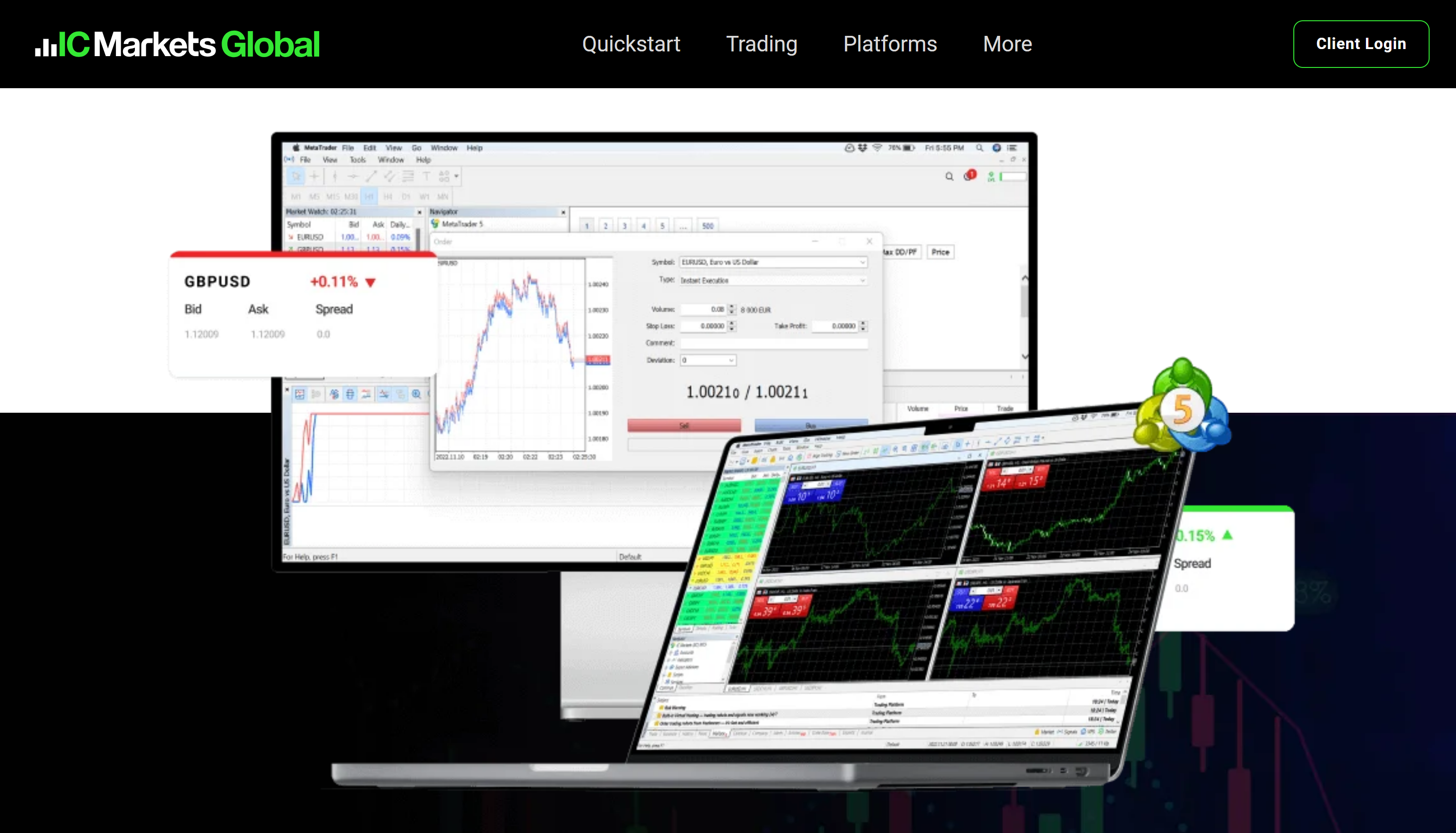

IC Markets offers a full suite of high-performance trading platforms and tools designed for speed, flexibility, and cost efficiency.

-

MetaTrader 4 & 5: Raw Spread accounts feature variable spreads from 0.0 pips on MT4 and a commission of USD 3.50 per lot/side on MT5.

-

cTrader: No deposit fees on most methods, intuitive interface, Level II pricing and cAlgo support.

-

WebTrader & Mobile Apps: Browser-based access with no inactivity fees and on-the-go trading (overnight swap rates apply).

-

Payments: Most deposits and withdrawals are fee-free (third-party fees may apply).

-

AutoChartist: Automated pattern recognition and market insights.

-

VPS Hosting: Virtual Private Server for ultra-low latency and uninterrupted EA execution.

IC Markets’ trading platforms and tools form a cohesive ecosystem that caters to every style and strategy - from scalping with raw spreads on MT4 to advanced algorithmic trading via cTrader and VPS hosting. Whether you’re execution-focused or research-driven, the combination of tight pricing, automated analysis with AutoChartist, and seamless access across desktop, web, and mobile ensures you have the speed, flexibility, and insights needed to maintain a competitive edge.

What trading platforms does IC Markets offer?

IC Markets gives you access to MetaTrader 4 and MetaTrader 5 for advanced charting, Expert Advisor support, raw spreads from 0.0 pips, and the intuitive cTrader platform with Level II pricing and algorithmic trading via cAlgo. You can trade directly in your browser through WebTrader or stay connected on the go with fully featured iOS and Android mobile apps - each designed for seamless order execution and customisable layouts.

What advanced tools are available to enhance my trading on IC Markets?

To help you identify and act on market opportunities, IC Markets integrates AutoChartist for automated pattern recognition and real-time analysis, plus optional VPS hosting to run your EAs and algorithmic strategies 24/7 with minimal latency. In addition, most deposit and withdrawal methods carry no broker fees, and retail accounts under ASIC and CySEC benefit from Negative Balance Protection, ensuring cost efficiency and financial security.

Mobile Use of ICMarkets

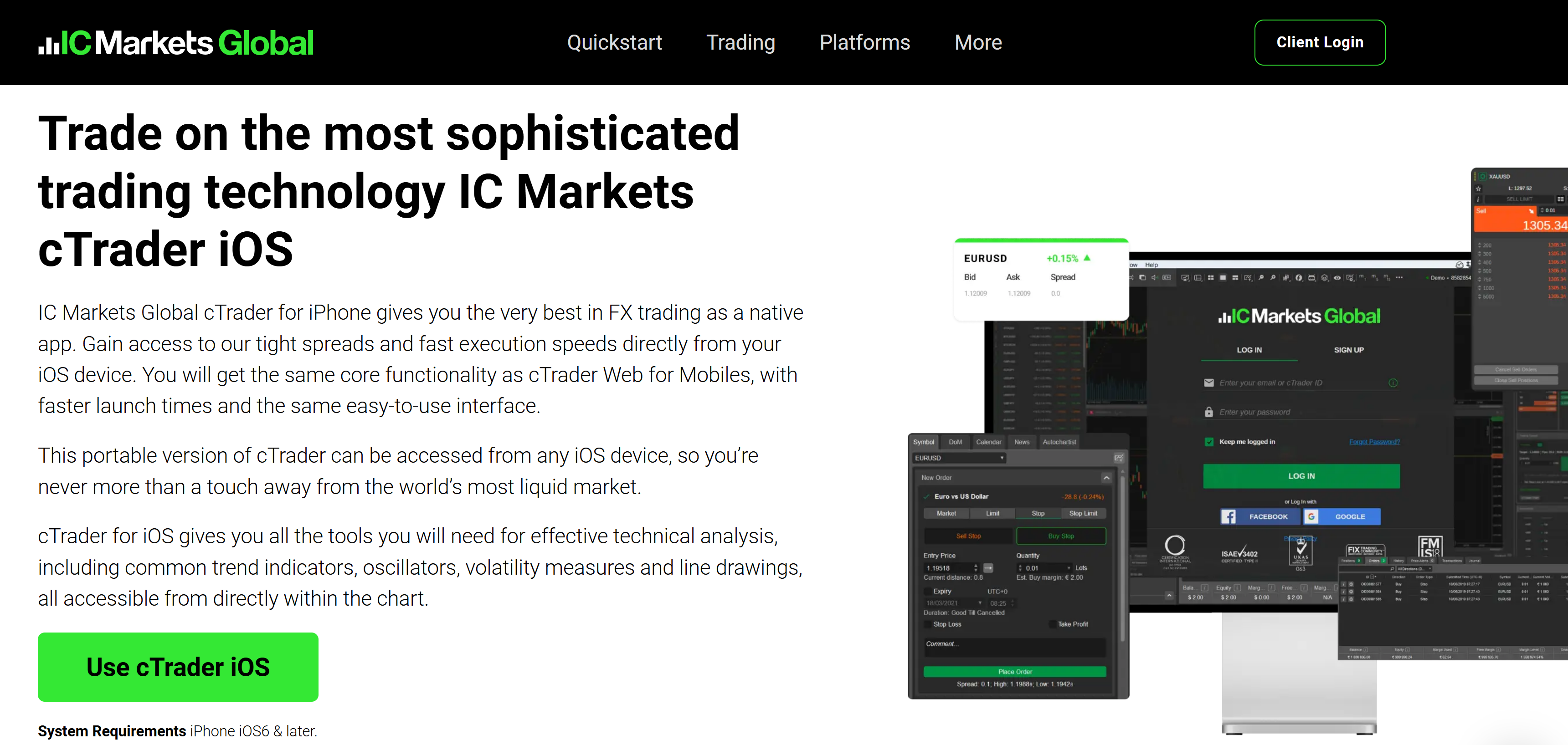

📱 ICMarkets Mobile Trading Experience

IC Markets’ mobile trading apps bring the full power of MetaTrader 4, MetaTrader 5, and cTrader to your iPhone or Android device. Each app is equipped with advanced charting tools, customisable indicators, and one-click order execution to monitor market trends and place trades from your dashboard instantly. Robust security features protect your data and funds, while 24/7 connectivity ensures you never miss an opportunity—giving you the freedom and flexibility to trade wherever you are.

📲 ICMarkets Mobile App Highlights:

-

Cross-Platform Compatibility: You can trade on MetaTrader 4, MetaTrader 5, and cTrader from your desktop, web browser, iOS, or Android device.

-

Customisable Interface: Tailor your workspace with adjustable layouts and quick-access menus for a more intuitive navigation experience.

-

Live Market Charts: Monitor price movements in real-time with a full suite of technical indicators, drawing tools, and multi-timeframe views.

-

Instant Order Execution: Place trades directly from the chart with a single tap, minimising delays and missed opportunities.

-

Integrated Account Controls: Handle deposits, withdrawals, and profile settings securely within the app’s client portal.

-

Around-the-Clock Support: Reach multilingual customer service 24/7 via live chat, email, or phone for immediate assistance.

-

Enterprise-Grade Security: Protect your data and funds with end-to-end SSL encryption and advanced account safeguard protocols.

-

Global Language Options: Navigate the app and communicate with support in your preferred language, meeting the needs of traders worldwide.

IC Markets mobile use combines powerful trading capabilities with rock-solid security and 24/7 support, delivering a truly on-the-go experience that keeps you connected to the markets wherever you are.

IC Markets integrates AI directly into its trading platform to give clear, data-driven insights rather than empty promises. You’ll get real-time market feeds and predictive models that help you spot opportunities faster. Automated tools sift through large datasets for pattern recognition and signal generation so that you can build custom strategies without manual chart scanning. On the risk side, AI monitors your positions and market moves to trigger protective measures and keep losses in check. All of this runs on the same secure infrastructure you trust, boosting efficiency and sharpening your decision-making.

|

Feature

|

Description

|

|

⏱️Real-Time Market Analysis

|

AI rapidly crunches vast datasets to deliver practical, ready-to-use insights.

|

|

📈Predictive Modeling

|

Machine learning models anticipate market shifts and highlight emerging opportunities.

|

|

🤖Algorithmic Trading

|

Automated algorithms execute trades with unmatched speed and pinpoint accuracy.

|

|

📋Personalized Strategies

|

AI-driven analytics shape bespoke trading strategies tailored to your goals.

|

|

🔍Pattern Recognition

|

Intelligent systems monitor and interpret market patterns to guide smarter decisions.

|

|

⚠️Risk Management

|

Adaptive AI fine-tunes your approach, helping to curb risk and protect capital.

|

|

📱Enhanced User Experience

|

User-friendly, AI-powered tools streamline every step of the trading process.

|

🌍 ICMarkets Markets Range

IC Markets offers direct access to a wide range of global markets so you can diversify and adapt your strategies:

With raw spreads and deep liquidity, you can trade over 70 currency pairs - majors, minors and exotics. Commodities cover precious metals (gold, silver) and energy products (crude oil, natural gas). Major stock indices such as the S&P 500, NASDAQ 100, FTSE 100 and DAX 40 are available via index CFDs, while share CFDs let you speculate on individual companies without owning the shares. Cryptocurrency CFDs include Bitcoin, Ethereum and Ripple, and futures/CFDs on other assets let you take positions on price moves without physical delivery.

All instruments trade through the same account, giving you straightforward portfolio management and the flexibility to switch between short-term trades and longer-term investments.

Which asset classes and markets can I trade on IC Markets?

You can trade Forex pairs (majors, minors, exotics), commodities (metals and energy), and global indexes and share CFDs, cryptocurrencies, and futures—all from a single account.

How does IC Markets support portfolio diversification and strategy flexibility?

By offering a broad mix of instruments under one platform, you can quickly shift capital between asset classes and tailor your approach to both short-term trades and long-term positions.

💸 ICMarkets Fees, Spreads, and Commission

Trading with ICMarkets incurs fees starting at USD 3.5 per lot, spreads as low as 0.0 pips, and commission-free trading options, depending on the selected account type.

|

Fee Type

|

Description

|

|

🪙 Spreads

|

Raw Spread accounts feature dynamic spreads that can narrow to 0.0 pips.

|

|

💸 Commissions

|

Trades on Raw Spread accounts incur a commission of USD 3.50 per lot each way.

|

|

💳 Deposit Fees

|

Depositing via most payment methods doesn’t attract any fees.

|

|

💰 Withdrawal Fees

|

Withdrawals are free for most methods, though external provider charges may apply.

|

|

⏳ Inactivity Fees

|

No inactivity charges make it suitable for traders who log in less frequently.

|

|

🌙 Overnight Fees

|

Holding positions through the night incurs swap rates, which differ by asset.

|

Does ICMarkets charge a commission?

Yes - commissions apply on Raw Spread accounts to keep spreads ultra-tight. You’ll pay USD 3.50 per lot per side on MT4/MT5 (USD 3 per lot per side on cTrader). Standard accounts use wider spreads instead and carry no additional commission.

Does ICMarkets have additional fees?

For the most part, no. Deposits and withdrawals are free on most methods (though your bank or payment provider may charge), and there’s no inactivity fee. The only routine costs are overnight swap rates for positions held past the trading day - these vary by instrument.

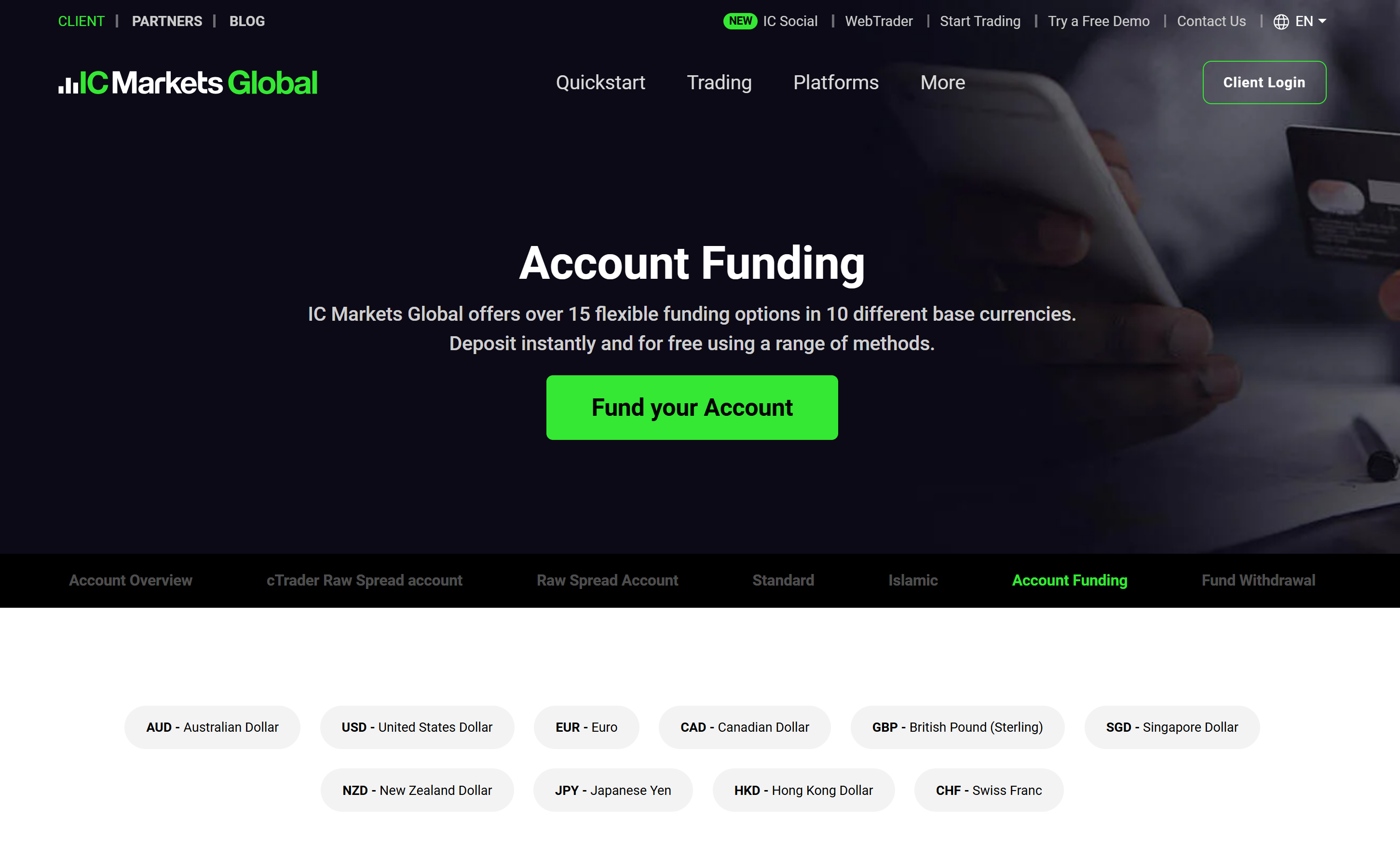

💳 ICMarkets Deposit and Withdrawal

ICMarkets offers a variety of payment methods to ensure seamless deposits and withdrawals for its clients. Traders can fund their accounts using bank wire transfers, credit/debit cards, and popular e-wallets such as Skrill, Neteller, and PayPal.

Withdrawals generally follow the same methods as deposits, except that certain credit/debit card withdrawals may be subject to issuer-specific restrictions.

How much does it cost to withdraw money from ICMarkets?

ICMarkets does not charge fees for standard withdrawals, but some payment providers may impose additional charges depending on the method used.

What deposit methods does ICMarkets support?

ICMarkets accepts bank wire transfers, credit/debit cards (Visa & Mastercard), PayPal, Neteller, Skrill, and other country-specific payment methods, depending on the trader’s location.

📚 ICMarkets Education and Research

ICMarkets provides a comprehensive education and research hub, offering traders valuable resources to enhance their market knowledge and trading skills.

The platform features diverse learning materials, including webinars, video tutorials, in-depth articles, and e-books, covering essential topics such as forex trading, technical analysis, and market trends.

In addition to educational content, ICMarkets’s dedicated research team publishes daily market analysis and trade alerts, equipping traders with up-to-date insights to support well-informed trading decisions.

Whether you are a beginner seeking foundational knowledge or an experienced trader looking to refine your strategies, ICMarkets’s education and research materials provide the tools to navigate the financial markets confidently.

|

🔎 Resource

|

🚀 Description

|

|

🎓 Webinars

|

Regularly hosted live sessions with experts covering trading strategies and market analysis.

|

|

📚 Tutorials

|

Step-by-step guides for beginners and advanced traders, focusing on platform usage and trading basics.

|

|

📝 Guides

|

Comprehensive written materials on trading tools, techniques, and market analysis.

|

|

📹 Video Lessons

|

On-demand video content covering various trading concepts, strategies, and platform features.

|

|

💬 Market Analysis

|

Weekly or daily reports, articles, and analyses on market trends to assist traders in decision-making.

|

Is ICMarkets’s market analysis reliable?

ICMarkets offers regular market analysis to help traders stay informed about market trends and potential opportunities. However, as a financial services provider, its insights should be a reference rather than absolute investment advice. Traders are encouraged to conduct independent research and consider multiple sources before trading.

What educational resources does ICMarkets provide?

ICMarkets offers a comprehensive suite of educational materials to support traders at all experience levels. These include daily market analysis, webinars, video tutorials, in-depth trading guides, an economic calendar, and a glossary of trading terms. These resources enhance traders’ understanding of the financial markets and improve their trading strategies.

📘 Forex Trading Guides

ICMarkets provides detailed and structured forex trading guides to equip traders with the essential knowledge and skills to navigate the forex market effectively. These guides cater to traders at all experience levels and cover everything from forex fundamentals and key market terminology to advanced trading strategies and risk management techniques.

To ensure accessibility, ICMarkets delivers these educational materials through multiple formats, including articles, e-books, videos, and webinars. Key topics include technical and fundamental analysis, offering practical insights that help traders make informed decisions in real-time market conditions.

ICMarkets’s forex trading guides provide a well-rounded learning experience by combining theoretical knowledge with practical trading insights. Whether you are a beginner looking to understand market mechanics or an experienced trader refining your strategy, these resources offer valuable insights into the dynamic forex landscape.

🔍 ICMarkets Cashback

When traders open a new ICMarkets trading account or link an existing one through a rebate service provider, ICMarkets pays a commission to the provider. A significant portion of this commission is returned to the trader as cashback. Significantly, this arrangement does not affect the trader's spreads or trading conditions; instead, it effectively reduces overall transaction costs, thereby improving profitability.

💰 Earning Potential

The amount of cashback earned depends on trading volume. For example, traders can receive up to $1.5 per lot. The higher the trading volume, the greater the cashback received. Traders can utilise cashback calculators provided by rebate services to estimate their potential earnings based on their trading activity.

📊 Payment and Monitoring

Cashback earnings are typically reported on the rebate service provider's dashboard in real-time. Payments are usually released a few days after the end of the month once the provider collects the cashback from ICMarkets. Traders can then withdraw their cashback using the available options the rebate service provides.

🌟 Benefits of ICMarkets's Cashback Program

-

💸 Cost Reduction: Receiving a portion of the transaction cost back as cashback effectively lowers the spread, enhancing the trader's win ratio.

-

🔎 Transparency: Rebate service providers offer real-time reporting, allowing traders to monitor their cashback earnings accurately.

-

⚖️ No Impact on Trading Conditions: Participating in the cashback program does not alter trading terms, such as spreads or commissions, ensuring that traders continue to operate under their preferred conditions.

⚠️ Considerations

It's important to note that cashback rates and terms can vary depending on the rebate service provider and the specific account type. Additionally, certain trading behaviours, such as closing positions within a short timeframe, may affect rebate eligibility. Traders should review the rebate service provider's terms and conditions to ensure compliance and maximise their cashback benefits.

By participating in ICMarkets's cashback program through reputable rebate service providers, traders can effectively reduce their trading costs and enhance overall profitability while maintaining their existing trading conditions.

📞 ICMarkets Customer Support

IC Markets’ customer care team is available around the clock during the trading week, ensuring rapid assistance Monday through Friday. Traders can connect via live chat, request a callback, or send an email, all backed by multilingual support to serve clients across different regions. These channels include:

-

Live Chat: Instant messaging for real-time problem-solving

-

Callback Requests: Schedule a phone consultation at your convenience

-

Email Support: Detailed responses and follow-up for complex inquiries

🔎 ICMarkets Customer Support Overview

|

📞 Support Channel

|

🕰️ Availability

|

⚡ Average Response Time

|

|

💬 Live Chat

|

24/7

|

Under 2 minutes

|

|

📧 Email Support

|

24/7

|

1 - 3 hours

|

|

📞 Phone Support

|

24/7

|

Immediate (during call)

|

|

📚 Help Centre (FAQs)

|

24/7

|

Instant (self-service)

|

|

📱 Social Media Support

|

Business hours only

|

Varies (usually within 24 hours)

|

What countries are ICMarkets restricted in?

Due to regulatory restrictions, ICMarkets does not provide services in the United States, Iran, Canada, Yemen, or the OFAC countries.

How do I contact ICMarkets support?

During operating hours, you can reach ICMarkets’s support team via Live Chat on ICMarkets.com, email, or phone support.

👍 ICMarkets Pros and Cons

|

✅ Pros

|

❌ Cons

|

|

Integration with social trading services like ZuluTrade and IC Social allows you to follow and copy top-performing traders.

|

The $200 minimum deposit can be higher than some competing brokers.

|

|

A stringent regulatory framework under ASIC and CySEC ensures a highly secure trading environment.

|

New traders may feel daunted by the platform’s array of instruments and advanced features.

|

|

Swap-free Islamic accounts are available for clients requiring Sharia-compliant trading.

|

No Bonuses or Promotions

|

|

Generous leverage up to 1:1000 gives traders the ability to amplify their positions.

|

Limited Range of Tradable Assets (No direct stocks or ETFs) - varies on the country

|

|

Fee schedules and trading conditions are transparent, so you always know your costs upfront.

|

|

|

Multiple Trading Platforms (MT4, MT5, cTrader)

|

|

|

No Deposit Fees

|

|

|

24/5 Multilingual Support

|

|

⚠️ Disclaimer

CFD trading uses leverage and complex mechanisms to magnify losses beyond your original investment. Before you begin, fully grasp these risks, evaluate your personal risk tolerance, and feel confident with the possibility of losses exceeding your deposited funds.

🔴 Investor Warning

Trading forex on margin carries substantial risk and isn’t suitable for every investor. Before you begin trading forex or CFDs, evaluate your financial objectives, experience level, and comfort with risk. Only use capital you can afford to lose, as you may incur partial - or even total - losses of your initial investment.

🔍 Our Review Methodology

Our broker reviews are built on a rigorous, side-by-side assessment of all the critical elements you need to consider - from regulatory oversight and trading costs to platform functionality and customer support. We clearly outline each broker’s strengths and weaknesses and assign an overall rating to guide you toward the best choice for your trading style.

Please remember that these evaluations are for informational purposes and are not a substitute for professional financial advice. We recommend consulting a qualified financial advisor before making trading or investment decisions. This same transparent methodology underpins our IC Markets review to ensure you have an accurate, unbiased picture of the broker.

🔚 Conclusion

In summary, IC Markets delivers a technically robust trading environment, offering deep liquidity and advanced execution that cater particularly well to Forex and CFD specialists.

Its edge in the market stems from consistently tight spreads, a choice of professional-grade platforms (MT4, MT5, cTrader), and a solid regulatory framework under ASIC and CySEC - features that resonate with novice investors and veteran traders.

To further strengthen its global appeal, IC Markets could enhance its service by expanding localised support in Asia and Africa, developing regional market insights, and tailoring educational materials to address those markets' specific needs and trading behaviours.

References

IC Markets Available Accounts Overview

IC Markets Regulation details

IC Markets Meta Trader 5